Tax Filing Made Simple: A Beginner’s Step-by-Step Guide

Filing taxes can seem like a daunting task, especially if you’re doing it for the first time. But fear not! This step-by-step guide will walk you through the process, making tax filing as smooth as possible. Let’s dive in and demystify the tax filing process together. 😊

Table of Contents

1. Understanding Tax Filing Basics

2. Gathering Necessary Documents 📄

3. Choosing the Right Tax Form 📝

4. Filing Your Taxes Online vs. Offline 🌐

5. Tips for a Stress-Free Tax Season 🧘

6. Conclusion

7. FAQs

1. Understanding Tax Filing Basics

Before we get into the nitty-gritty, let’s cover some basics. Tax filing is essentially reporting your income to the government and determining how much tax you owe or the refund you’re eligible for. In the U.S., the deadline for individual taxpayers is typically April 15th. Missing this date can lead to penalties, so timely filing is crucial!

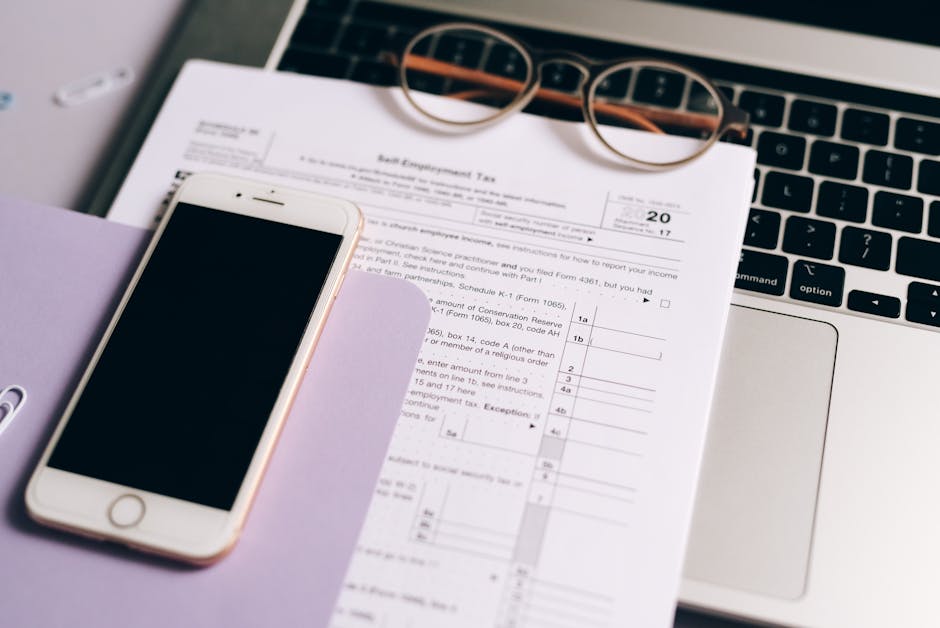

2. Gathering Necessary Documents 📄

The first step is to collect all your relevant documents. Here’s a checklist to get you started:

– W-2 forms from employers

– 1099 forms for additional income

– Previous year’s tax return

– Any receipts for deductions such as medical expenses or charitable donations

– Social Security number or Tax Identification Number

Having these documents on hand will make the filing process much smoother. Trust me, scrambling for paperwork at the last minute is no fun! 😅

3. Choosing the Right Tax Form 📝

Next up is selecting the correct tax form. For most individuals, the 1040 form is the go-to choice. However, there are simplified versions like the 1040EZ for those with straightforward tax situations. Make sure to choose the form that best matches your financial circumstances to ensure accuracy.

4. Filing Your Taxes Online vs. Offline 🌐

Today, you have the option to file your taxes online or offline. Online filing is often faster and more convenient. Many platforms offer step-by-step guidance and even error-checking features. If you prefer the traditional route, you can file by mail, though it may take longer to process.

Consider your comfort level with technology and choose the method that suits you best. Either way, ensure you receive confirmation of your submission.

5. Tips for a Stress-Free Tax Season 🧘

To make tax season as stress-free as possible, here are some tips:

– Start early: Give yourself ample time to gather documents and fill out forms.

– Double-check your work: Errors can lead to delays or rejections.

– Seek help if needed: Don’t hesitate to consult a tax professional for guidance.

– Stay organized: Keep a folder for tax-related documents throughout the year.

With these tips, you’ll be well on your way to a smooth tax filing experience!

Conclusion

Filing taxes doesn’t have to be a nerve-wracking ordeal. By understanding the basics, staying organized, and choosing the right tools, you can make the process manageable and even straightforward. Remember, it’s all about preparation and taking it step by step. Happy filing! 🎉

FAQs

Q: What happens if I miss the tax filing deadline?

If you miss the April 15th deadline, you may face penalties and interest charges. It’s best to file for an extension if you know you won’t make it on time.

Q: Can I file my taxes for free?

Yes, many online platforms offer free tax filing for individuals with simple tax situations. Check if you qualify for free services before paying for tax software.

Q: How do I know which tax deductions I qualify for?

Research common deductions and consult the IRS website or a tax professional. Deductions can vary based on your income and expenses, so it’s worth investigating.

Q: Is it better to file online or offline?

Both methods have pros and cons. Online filing is faster and more convenient for many, but if you prefer paper, offline filing is still a valid option. Choose what’s most comfortable for you.

Q: What should I do if I make a mistake on my tax return?

If you realize a mistake after filing, you can file an amended return using Form 1040-X. It’s important to correct errors to avoid any issues with the IRS.